Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stripe processes payments brilliantly but delivers terrible analytics for subscription businesses. The basic reporting falls apart when you need granular SaaS metrics. Enter specialized analytics platforms that transform raw Stripe data into actionable business intelligence. We’re talking 28+ SaaS metrics in real-time instead of Stripe’s limited transaction summaries.

Baremetrics exemplifies this evolution. Direct Stripe integration pulls transaction data and generates Monthly Recurring Revenue (MRR), churn rates, Customer Acquisition Cost (CAC), and Lifetime Value (LTV) calculations that Stripe simply doesn’t provide. The transformation eliminates spreadsheet hell that traditionally plagued SaaS financial reporting.

Traditional Stripe reporting shows transaction volumes and success rates. SaaS businesses need cohort analysis, expansion revenue tracking, and churn attribution. These metrics require complex calculations across multiple data dimensions that Stripe’s basic dashboard can’t handle.

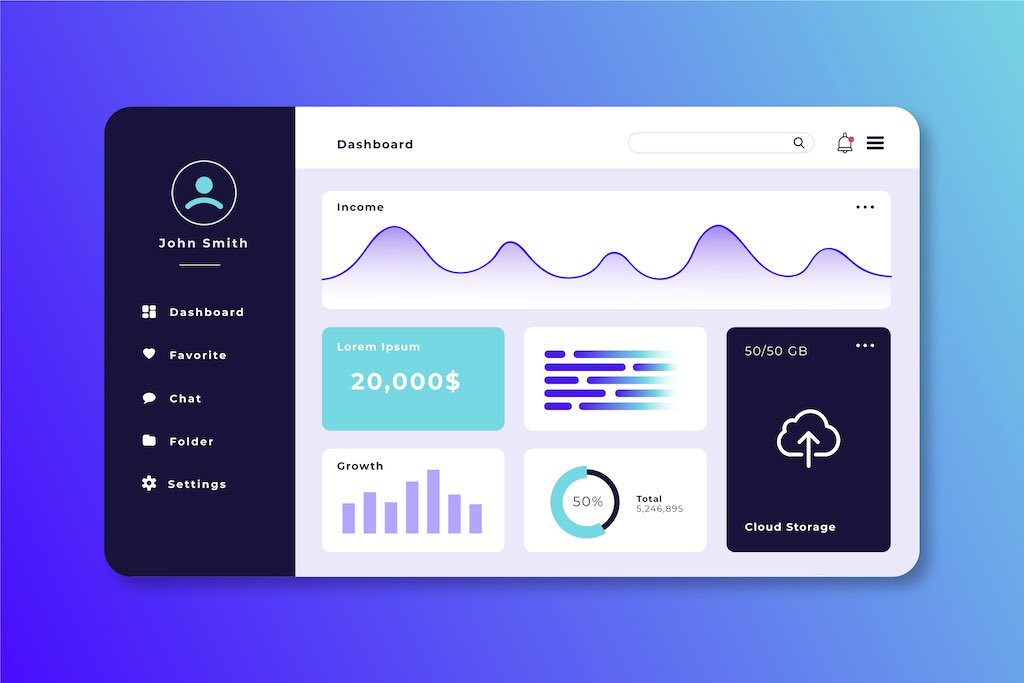

Advanced analytics platforms handle these calculations automatically while providing visual dashboards that make trends immediately apparent. Real-time updates show MRR changes as they happen instead of requiring manual calculation from raw transaction logs.

SaaS businesses rarely use single payment processors. Stripe handles credit cards, PayPal processes some transactions, direct bank transfers for enterprise customers. Traditional reporting tools struggle with multi-platform reconciliation.

Advanced platforms integrate multiple payment systems and provide unified reporting across different processors. The consolidation eliminates manual data entry and reduces errors from handling separate reporting systems for different payment methods.

Baremetrics supports multiple Stripe accounts plus integration with other payment platforms. This matters for businesses with different legal entities, geographic regions, or product lines that require separate payment processing but need consolidated financial reporting.

Basic Stripe reporting shows failed payments as simple transaction failures. SaaS analytics platforms identify failed payments as churn risk and trigger automated recovery workflows. Dunning management becomes proactive rather than reactive.

The systems analyze churn patterns to identify at-risk customer segments before cancellations occur. Predictive models use engagement data, payment history, and usage patterns to calculate churn probability and recommend retention interventions.

Stripe’s Reporting API supports custom analytics but requires significant development effort to build meaningful SaaS dashboards. The API provides raw transaction data but lacks the business logic needed for subscription-specific metrics.

Advanced platforms handle the technical complexity while providing business-friendly interfaces. Teams get sophisticated analytics without requiring data engineers to build custom reporting infrastructure. The time savings allow focus on business optimization rather than data processing.

Integration typically requires read-only API access to Stripe accounts. Data synchronization happens automatically with real-time updates for critical metrics. Historical data imports provide baseline measurements for trend analysis.

The evolution reflects SaaS businesses’ maturation from simple payment processing to sophisticated revenue operations that require specialized analytics capabilities beyond traditional payment processor reporting.